The questions the Novaworks Support Team encounters the most from Risk Return preparers involve labels. The same strict structure that makes it more of a fill-in-the-blank process when filing Risk Return causes a lot of trouble when it comes to customizing labels. The

Risk Return taxonomy is designed so that the labels and presentations are difficult for users to change. This design is purposeful, as prospectuses should look the same to provide investors with clear and concise data so they can make informed decisions.

But that doesn’t mean there is no flexibility for Risk Return, or that you can’t get the SEC’s

XBRL Viewer to render your report to match the original prospectus. Let’s go over some of the challenges that come with Risk Return labels and what can be done to overcome those challenges.

How do I get multiple classes to have the same name?

Two different elements cannot have the same

standard label. So if one class has the label “Class A” and your prospectus is organized such that there is another, different “Class A” class, then you have a problem. The easiest solution is to adjust the labels so that they are different, which is usually done by adding the class or series identifier to each label. However, this solution may not be ideal. When reading the report in the XBRL Viewer, “Value Fund” looks better than “Value Fund (S000000001)” and “Class A” looks neater than “Class A (C000000002)”.

There’s another option that is fairly simple. You’ll still need to keep the standard labels different. We recommend (as above) using the series/class identifiers to make the standard labels different. Then, in the presentation linkbase, use a preferred

label role on each dimension label and create a terse label. Set the terse labels to be the shortened “nice” labels. Unfortunately, this needs to be done on all presentations but it is worth the effort to have a neater look in the SEC Viewer and previewer.

How do I get a series and class to have the same name?

Thought this may seem like a unique problem, this challenge is actually identical to the previous problem. Two elements cannot have the same standard label, even if one element represents a series and the other represents a class. Since this is the same challenge as above, the solution to use a terse label role is the same. However, unlike the above problem, you may have an issue when the Average Annual Total Returns table is rendered by the SEC Viewer.

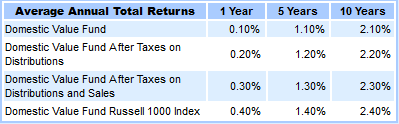

Normally, any index funds use the series dimension to prevent overlap with other series. When you have a single series and class combination with the same name, it creates a labeling issue when the report is viewed on the

EDGAR System. The SEC’s Viewer adds the series name to all rows of the table, as seen below.

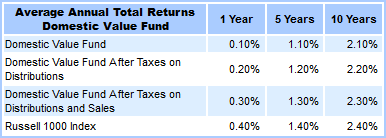

The solution to this is to edit the

embedded XBRL so it filters rows by the LegalEntityAxis value instead of filtering columns by the LegalEntityAxis. Once the embedded XBRL is changed, the table will look like this:

Can I have different labels for the same concept for different summaries?

Can I have different labels for the same concept for different summaries?

In short, the answer is: no. You can’t have different labels for the same concept for different summaries in the prospectus unless the element is one of the few that users are allowed to change. When using the standard Risk Return

linkbases, there are very few elements that have mutable relationships. For example, you cannot change the label role for the MaximumAccountFee element on the Shareholder Fees presentation, but you can change the label role for the RedemptionFee and RedemptionFeeOverRedemption elements.

What this means is that, while you can set the standard label for most elements, you can not have different labels for these elements on different presentations. This is by design to make each table of information clear to investors and avoid any misleading language. If your report has different labels for the same concept, you should be asking yourself why. Unless there’s a compelling reason, it might be time to review your original prospectus.

If you must have different labels for the same concept, you can opt to not use the standard Risk Return linkbases. Doing so will give you full control over your report’s rendering. However, not using the default linkbase means your report may not follow the standard presentation structure. The key word there is “may”; your report can still follow the standard structure by duplicating the same relationships that the standard linkbases contain. Since the linkbases in a non-standard report cannot be easily checked against the

standard linkbases, we really recommend that you don’t do this. The better option is to attempt to determine why your report has different labels for the same concept.

For a complete list of the elements whose roles may be changed, check the Mutual Fund Risk/Return Summary

Preparers Guide (a link is provided in the references below).

_______________________

Sources:

http://xbrl.sec.gov/rr/2012/rr-preparers-guide-2012-03-26.pdf

http://xbrl.sec.gov/rr/2010/rr-rendering-2010-02-28.pdf