With each new year the Financial Accounting Standards Board (FASB) releases an updated version of the

US-GAAP Taxonomy (

UGT). These new releases are not meant to increase the work of filers but rather to improve the quality of

XBRL reporting. Changes in the taxonomy include not only Accounting Standards Updates (ASUs) but also incorporate feedback from the filing community. Even though the SEC is slow to adopt the new taxonomy (it’s been almost six months since its initial release by FASB), it is important for companies to review the taxonomy ahead of time to see what is new and give feedback on the changes.

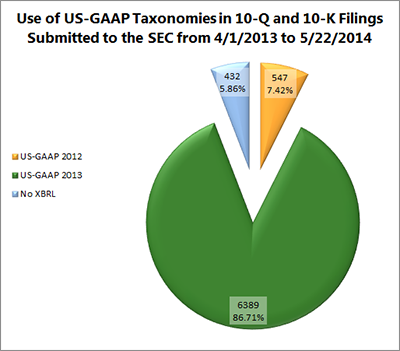

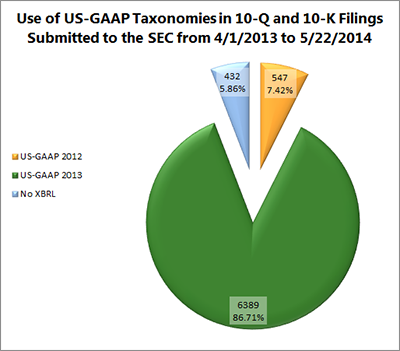

For many filers, this won’t be an issue. Based on an analysis of the first quarter filings transmitted to

EDGAR in 2014*, only 7.42% of reports are still being submitted using the 2012 taxonomy.

If you aren’t filing using the 2012 taxonomy, then you’re already familiar with the idea of transitioning to a new

GAAP taxonomy. But you may have questions about how to smooth that transition or perhaps the elements you used between 2012 and 2013 weren’t affected by any changes to the taxonomy and you’re facing a different challenge this year.

But first, let’s find out...

What’s New in 2014

The

2014 UGT introduces many new elements that either come from ASUs or feedback from the community. The latter is actually where the majority of these new elements originate, which is good news for the filing community. FASB is listening to your concerns and addressing issues to improve the taxonomy to help filers more easily represent their financials in

XBRL.

403 new elements: This taxonomy introduces 27 new elements to address ASUs and 376 elements that were created by FASB as a result of a review of filings, comments from the public, and internal analyses. The 376 elements include, among other changes, 21 new elements for the Insurance Industry Resource Group, 28 new elements to represent aircraft members, 18 new elements that accommodate accumulated unrealized gain (loss) disclosures for securities, 56 new elements related to disclosures for balance sheet offsetting and a Tax Period axis to accommodate disclosures by various tax periods.

A simplified calculation linkbase: Previously the calculation linkbase was presentation oriented; now it is data oriented, which removes redundancy within the taxonomy. This simplified linkbase can help you choose the best elements for your data.

Documentation and label changes: The update also includes many documentation and label clarifications based on user feedback. The documentation labels for approximately 500 elements that pertain to maturity schedules were changed to clarify the appropriate use of elements. Documentation labels were also changed to clarify the meaning of a concept, to correct grammatical or spelling errors, to remove unnecessarily restrictive wording, to correct inconsistencies between the labels and the definitions of elements, and to incorporate new ASUs. Additionally, a number of elements had their standard, period start, period end, or total labels modified to better identify their intended applications.

177 deprecated elements: Elements were deprecated to coincide with ASUs among other reasons. If a deprecated element is superceded by another element, preparers can review an element’s Deprecated Label to locate a replacement element. Preparers can also use the definition linkbase to view relationships between deprecated elements and other elements within the taxonomy. Deprecated elements will remain in the taxonomy for two years to aid in transitioning reports and viewing legacy documents but should not be used in new filings.

Removal of the 2011 UGT deprecated elements: With EDGAR Release 13.1 last year, the 2011 US-GAAP Taxonomy was no longer accepted by the SEC. Elements that were deprecated in the 2011 UGT will no longer appear in the 2014 UGT.

So what does this mean for registrants and preparers?

The good news:

In the 2014 taxonomy, there are significantly fewer deprecated elements.

Transitioning from 2013 means you are less likely to run into elements that have been deprecated. On the other hand, if you are transitioning from 2012, you’ll have to deal with not only the elements that were deprecated in 2014 but also all of the elements that were deprecated in the previous year. That’s not an insignificant number of elements, so it’s important to stay on top of new taxonomies as they are approved by the SEC.

The simplified

calculation linkbase should aid preparers in making better decisions during element selection. Additionally, FASB took many comments and concerns from the public into consideration in modifying documentation and labels to help clarify concepts and elements, which should be helpful in identifying problems with element selection in your company’s financials.

The not-so-good news:

Changing taxonomies can be a time consuming affair depending on how your original XBRL was created. If you find that many of your element choices have become deprecated, you may wonder: “Why did they do that?” and “What should I do?”. Continuing to use a

deprecated element is the easiest choice; after all, the element will remain in the taxonomy for two years. But it is never the best choice.

Elements are deprecated for good reasons. Sometimes the reason is simple: the element is redundant or has been superceded by a newer element. Other times, elements could be deprecated because they are no longer needed due to an ASU or because their use by the community was infrequent. In any case, ignoring the problem is just going to make thing worse. It will be more work in the long term to update your filings if you wait until the last minute to

transition to new taxonomies.

As an

XBRL preparer, you should use this adoption time to find out how the elements you use have changed. The best approach to updating your filings to the

new taxonomy is to read the changes when it affects an element you have previously used and you can do this using the taxonomy itself. The

label linkbase is updated each release with information on how the linkbase has changed. For example, the “Deprecated Label” contains the reason the element was deprecated and even possible replacements. The “Change Label” describes why the label has been changed. Knowing where to look can save you time before the filing deadline.

FASB’s

taxonomy release notes also often state the reason for deprecating an item and also include information that should help you decide what element or elements to use in its place. The release notes are a helpful resource if your financials are affected by any recent ASUs.

Take advantage of the resources FASB has to offer and start reviewing the taxonomy as soon as possible. Procrastination will only make your transition more painful. You can also take the time to become more involved in the

XBRL filing community. Being part of the

XBRL community is more than just using XBRL. Become a member of organizations like XBRL US and participate in committees like their Best Practices Committee. These resources are a great way to improve your own

XBRL filings and improve the

data quality being provided by the community as a whole.

While it may seem like your concerns are going unnoticed, FASB is listening. They are making changes based on community feedback, so now is the perfect time to participate and let your voice be heard. As a community, we can work together to shape the landscape of XBRL reporting and bring to the forefront the issues that are most important to the filers.

* Statistics are based on 10-Q and 10-K filings submitted to the SEC between 4/1/2014 and 5/22/2014. If you’d like to learn more about how filers made the transition to the

2013 UGT, download Novaworks’ free XBRL analysis for the 2013 calendar year available at the end of this article.

_______________________

Sources:

http://www.fasb.org/jsp/FASB/Page/SectionPage&cid=1176163688345

http://www.sec.gov/info/edgar/edmanuals-vol1-17_d.htm

Additional Resources:

http://www.xbrl.us