In XBRL as in other data reporting systems, calculations show relationships among data. Since XBRL defines calculations in this way without validating the accuracy of their results, it is important to examine the results of calculations in XBRL filings. Many preparers may assume that when a calculation does not add up, it is due to rounding, but this may not be a safe assumption.

Rounding is almost unavoidable when reporting computations, and round-off error can propagate and increase in a series of mathematical operations. Error can be reduced by rounding with both the appropriate rounding method and at the appropriate point in a calculation or a sequence of calculations. There are multiple methods of rounding numerical values and for dealing with scenarios where there is a “tie” between rounding up or rounding down. XBRL uses the half to nearest even method as a tie-breaker where if the fractional part of a numerical value is 0.5, the value becomes the nearest even integer. An advantage of this method is that it treats positive and negative values symmetrically and is thus free of sign bias (as consistently rounding half up creates more positive results, for instance). However, this may not be the rounding method employed by financial preparation or spreadsheet software packages. It is important to ensure a correct, consistent rounding method is used throughout the preparation process so that reported results match what would be reached performing the calculations using the data reported in the XBRL filing.

Rounding is almost unavoidable when reporting computations, and round-off error can propagate and increase in a series of mathematical operations. Error can be reduced by rounding with both the appropriate rounding method and at the appropriate point in a calculation or a sequence of calculations. There are multiple methods of rounding numerical values and for dealing with scenarios where there is a “tie” between rounding up or rounding down. XBRL uses the half to nearest even method as a tie-breaker where if the fractional part of a numerical value is 0.5, the value becomes the nearest even integer. An advantage of this method is that it treats positive and negative values symmetrically and is thus free of sign bias (as consistently rounding half up creates more positive results, for instance). However, this may not be the rounding method employed by financial preparation or spreadsheet software packages. It is important to ensure a correct, consistent rounding method is used throughout the preparation process so that reported results match what would be reached performing the calculations using the data reported in the XBRL filing.

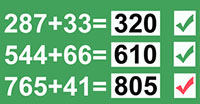

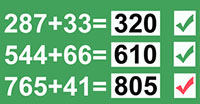

Perhaps even more important than sticking to a standard method of rounding, the rounding itself needs to be completed at the correct point in the calculation. When computing a sum, for example, rounding the addends before performing the addition can produce a different answer than leaving the addends unrounded and instead rounding the sum. In most cases, rounding the numbers involved in an arithmetic operation before performing the operation is preferable to rounding the result.

Rounding is one of the many important aspects in maintaining control over data quality. Ideally errors are avoided by taking care to round before XBRL statements are prepared. It is up to the preparer to ensure rounding practices are consistent and precision is maintained to the acceptable number of significant digits for numerical values.Because incorrect calculation results do not generate errors with the SEC, the results should be inspected for accuracy (as can be done with GoFiler’s validation tool). Depending on the size of the error, improper rounding could be the cause. It is important not to assume automatically that round-off error is the source of the problem, however. In addition, if errors are found, it is important not to address the issue in only the XBRL as it will then fail to match the HTML. If the data fails to add up, registrants should make sure the calculations are correct; likewise, filing agents should check with their clients to determine the best way to remedy this situation.

Rounding is almost unavoidable when reporting computations, and round-off error can propagate and increase in a series of mathematical operations. Error can be reduced by rounding with both the appropriate rounding method and at the appropriate point in a calculation or a sequence of calculations. There are multiple methods of rounding numerical values and for dealing with scenarios where there is a “tie” between rounding up or rounding down. XBRL uses the half to nearest even method as a tie-breaker where if the fractional part of a numerical value is 0.5, the value becomes the nearest even integer. An advantage of this method is that it treats positive and negative values symmetrically and is thus free of sign bias (as consistently rounding half up creates more positive results, for instance). However, this may not be the rounding method employed by financial preparation or spreadsheet software packages. It is important to ensure a correct, consistent rounding method is used throughout the preparation process so that reported results match what would be reached performing the calculations using the data reported in the XBRL filing.

Rounding is almost unavoidable when reporting computations, and round-off error can propagate and increase in a series of mathematical operations. Error can be reduced by rounding with both the appropriate rounding method and at the appropriate point in a calculation or a sequence of calculations. There are multiple methods of rounding numerical values and for dealing with scenarios where there is a “tie” between rounding up or rounding down. XBRL uses the half to nearest even method as a tie-breaker where if the fractional part of a numerical value is 0.5, the value becomes the nearest even integer. An advantage of this method is that it treats positive and negative values symmetrically and is thus free of sign bias (as consistently rounding half up creates more positive results, for instance). However, this may not be the rounding method employed by financial preparation or spreadsheet software packages. It is important to ensure a correct, consistent rounding method is used throughout the preparation process so that reported results match what would be reached performing the calculations using the data reported in the XBRL filing.