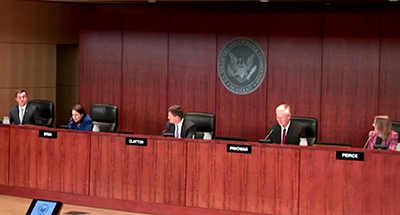

On June 28, 2018, the SEC held an open meeting in which they presented several final, approved rules and new rule proposals. Taken together, these changes represent progress toward many of the Commission’s priorities.

Included in the measures:

Included in the measures:

- Adoption of amendments to modernize the definition of “smaller reporting company”, which was established in 2008 (read more).

- Adoption of amendments to require the use of Inline XBRL in certain filings. This change, which was formally proposed in 2017, has been under review and study for numerous years (read more).

- A proposal that would permit certain exchange-traded funds to operate without first obtaining a fund-specific exemptive order from the SEC. This is a process that has not changed since exchange-traded funds were first approved in 1992 (read more).

- Adoption of amendments pertaining to disclosures of liquidity risk management for open-end funds. This change was proposed earlier this year (read more).

- A proposal to amend rules that govern the SEC’s whistleblower program, which was first adopted seven years ago (read more).

You will be able to view the webcast of the open meeting on sec.gov.

Sources:

SEC Approves Final and Proposed Rules in Latest Open Meeting (www.sec.gov)

SEC Expands the Scope of Smaller Public Companies that Qualify for Scaled Disclosures (www.sec.gov)

SEC Adopts Inline XBRL for Tagged Data (www.sec.gov)

SEC Proposes New Approval Process for Certain Exchange-Traded Funds (www.sec.gov)

SEC Adopts Targeted Changes to Public Liquidity Risk Management Disclosure (www.sec.gov)

SEC Proposes Whistleblower Rule Amendments (www.sec.gov)